Burgess: Ind. GOP supermajorities slip in cigar tax in dead of night

Tucked in the state's budget bill are new taxes on premium cigars, an effort to fill a $2.4 billion budget shortfall

***

Editor’s note: Join myself and Kaylie Klausing for a Substack Live discussion with Virginia House of Delegate candidate Jessica Anderson at 12p ET on the Substack App

Read all of our coverage of the Virginia House of Delegates races in the newsletter, “Sic Semper Tyrannis” (that’s the state motto, for all the non-Dominion folks.)

In case you missed me on CBS News’ “America Decides”, Friday, you can catch me here. I was on with Major Garrett and Mychael Schnell talking about the state of things, offering some perspective on what the country is going through.

The following is a guest post from 24sight friend Rob Burgess, veteran Hoosier and head of Connector, Inc., on a Sine Die surprise slipped into the state budget before lawmakers left town last week.

Cheers,

Tom LoBianco

***

The GOP supermajority promised to defend small business and low taxes. Instead, they sacrificed Indiana’s retailers to cover bad budgeting.

By Rob Burgess, CEO of Connector, Inc.

Indiana has long been seen as a beacon of conservative governance — a place where low taxes, personal freedom, and pro-business policies weren’t just slogans, but principles. Sadly, with the passage of House Bill 1001, that reputation is crumbling.

In the early morning hours of April 25, 2025, Indiana’s Republican-controlled legislature passed a two-year, $43 billion budget. Hidden deep in the budget was a blow to small businesses and individual liberty: a sharp tax hike on premium cigars and other tobacco products.

The numbers are clear, and they are damning:

• Tobacco Products Tax Rate: Increased from 24% to 36% of wholesale price.

• Cap on Cigar Tax: Tripled from $1.00 to $3.00 per cigar, applying to cigars wholesaled above $8.33.

This move, endorsed by Republican majorities in both chambers and set to be signed by Republican Governor Mike Braun, is nothing short of a betrayal of the very small businesses and entrepreneurs that conservatives claim to support.

Premium cigar retailers across Indiana — family-owned, community-focused, and compliant businesses — were blindsided. No public hearing. No targeted fiscal impact study. Just a late-night deal that sacrificed them to cover a $2.4 billion projected revenue shortfall.

And like most government “projections,” that shortfall is almost certainly inflated, based on flawed assumptions that will shift long before the ink on this budget is dry.

Across the state — from South Bend to Bloomington, from Muncie to New Albany — Indiana’s small businesses are now under siege.

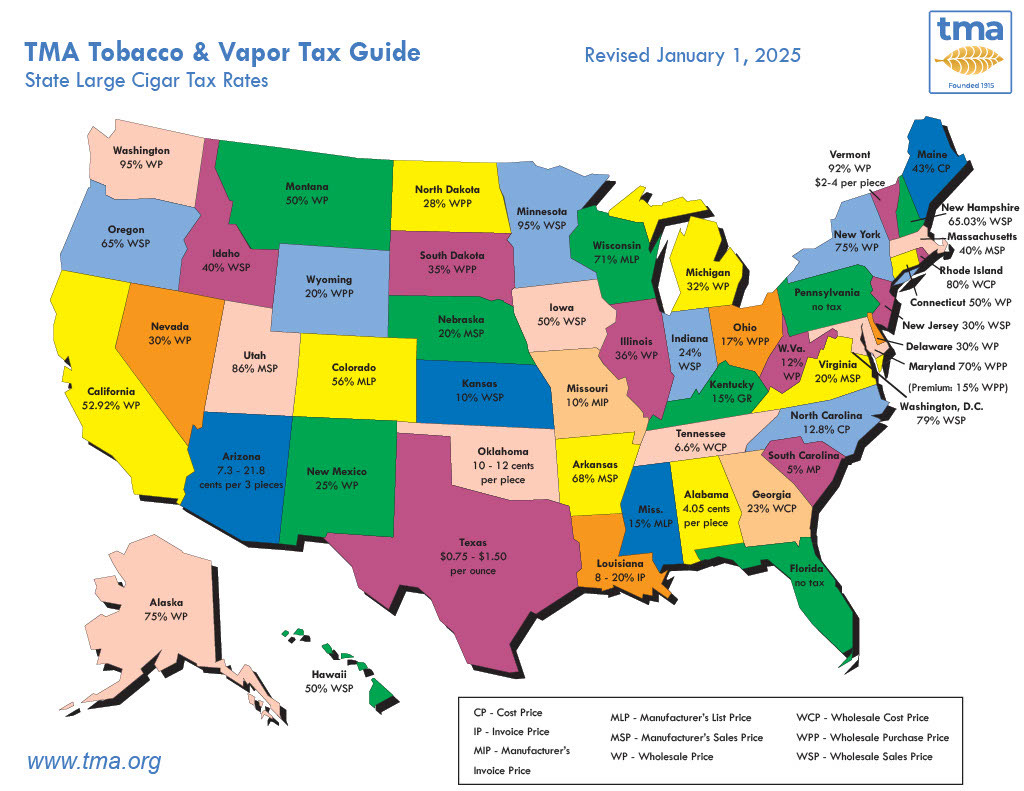

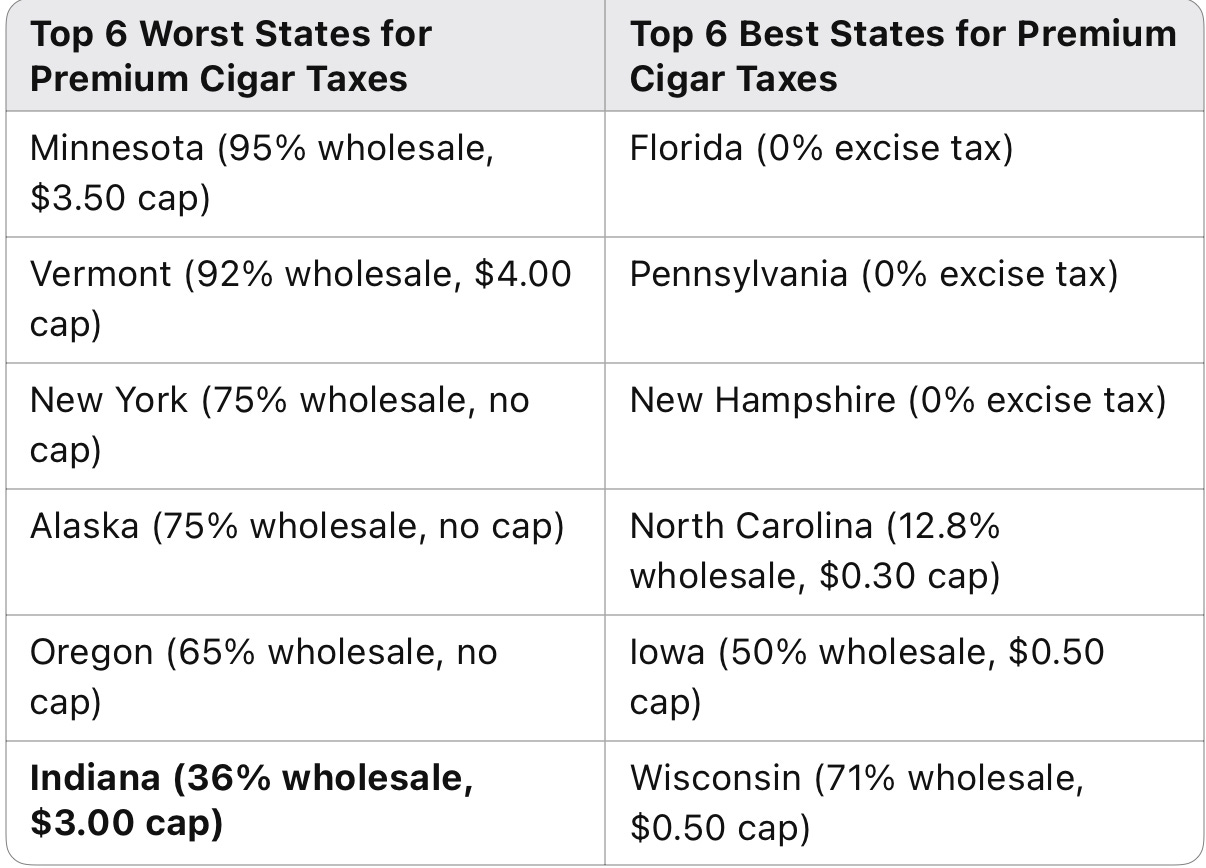

Premium cigar businesses already operate in a challenging environment, facing federal excise taxes and standard state sales taxes. Piling a new 36% wholesale tax on top — capped at $3.00 per cigar — will place Indiana among the worst states in the nation for premium cigar taxation.

Here’s where Indiana now stands:

It’s a stunning fall for a state that once prided itself on attracting and nurturing small businesses. Indiana now stands closer to New York, Minnesota, and Vermont than to states like Florida, Pennsylvania, and New Hampshire — all of which have chosen growth over punitive taxation.

The arguments for the new cigar tax collapse under scrutiny.

Premium cigars represent a tiny share of tobacco sales, and their consumers are overwhelmingly adults. Even federal regulators have acknowledged that premium cigars are fundamentally different from mass-market tobacco products.

Instead of bringing in meaningful revenue, Indiana’s tax hike will:

• Drive consumers to lower-tax states like Ohio, Kentucky, and Michigan.

• Accelerate the shift toward out-of-state online retailers.

• Lead to layoffs, closures, and lost community gathering spaces across Indiana.

• Deprive towns and cities of local sales tax revenue and economic vitality.

The tax won’t fix the deficit. It will hollow out the backbone of Indiana’s retail economy.

For years, Indiana Republicans campaigned on promises to cut taxes, grow small businesses, and defend economic liberty. Yet when pressure mounted, they abandoned those principles in favor of expedient, shortsighted policymaking.

Limited government was replaced with targeted industry punishment. Free markets were replaced with burdensome taxation. Supporting Main Street was replaced with sacrificing it.

Conservatives expect — and deserve — better.

Voters didn’t elect a supermajority to grow taxes quietly in the dead of night. They elected a supermajority to make the hard choices: cut waste, reform spending, and unleash small businesses to create growth.

Instead, they got a betrayal.

Please RSVP here, we look forward to seeing you.

The damage from HB1001 will not be abstract. It will be felt in empty storefronts, lost jobs, shuttered lounges, and weakened communities.

The premium cigar industry — and every small business sector that believes in freedom and entrepreneurship — must:

• Identify every legislator who voted for this bill.

• Mobilize voters, consumers, and small business owners.

• Support candidates who understand real conservative governance.

• Challenge incumbents who betrayed their base.

But fighting back doesn’t just mean punishing betrayal — it means offering a better path forward.

Indiana’s path is clear, repeal the premium cigar tax hike and restore the previous rates and cap. Carve out premium cigars from punitive tobacco tax categories, following the lead of Florida, Pennsylvania, and New Hampshire, which exempt premium cigars from state OTP taxes entirely.

Voters must demand Indiana Republicans repeal the tax hike, restore fairness to Indiana’s tax code and deliver the pro-growth, pro-freedom policies conservatives were promised.

Indiana doesn’t have to fall into the ranks of New York and Minnesota. But it will, unless the people who built this state stand up and take it back.

Indiana’s leadership made their choice. Now it’s time for small business advocates and conservatives to make theirs.

Indiana’s future — and the future of free enterprise — is too important to leave in the hands of politicians who forgot who they serve.

It’s time to stand up. It’s time to fight back. And it’s time to remind those in power that Main Street matters — and that the people who built this state aren’t going anywhere.

Rob Burgess is a national Republican strategist and Chief Executive Officer at Connector, Inc. — a boutique government relations and political affairs firm with offices in Washington, D.C., and Dallas, Texas.